Take Control of Financial Promotions Compliance

Control, manage and approve financial promotions with bethebrand. Automate workflows, cut FCA compliance risk and speed up approvals with full audit trials.

Financial promotions are essential, but compliance can be challenging to coordinate. Luckily, bethebrand makes it simple. Built for financial services organisations, with bethebrand you’ll streamline approvals, stay fully compliant, and have complete oversight at every step.

By automating processes, you also significantly reduce the cost of managing financial promotions, while minimising errors and ensuring faster approval times.

With over 20 years of Financial Services expertise, our team will get you set up quickly, tailoring the system to your needs.

Financial promotions can be complex, high-stakes and time-sensitive. With bethebrand, you can optimise every step, from creation to approval and distribution. Your team will work faster without ever compromising compliance.

Substantiate every claim with the ability to attach supporting proof, simplifying the approval process and meeting FCA requirements.

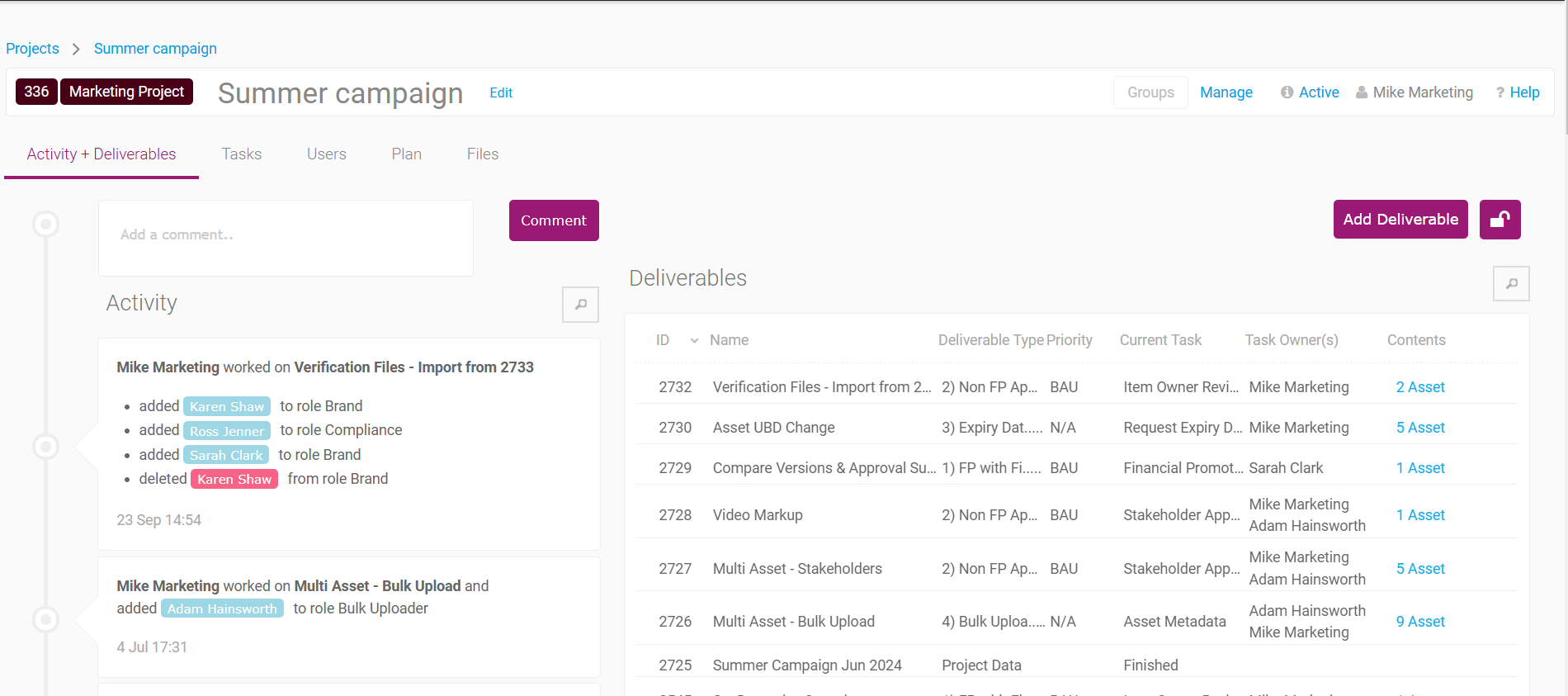

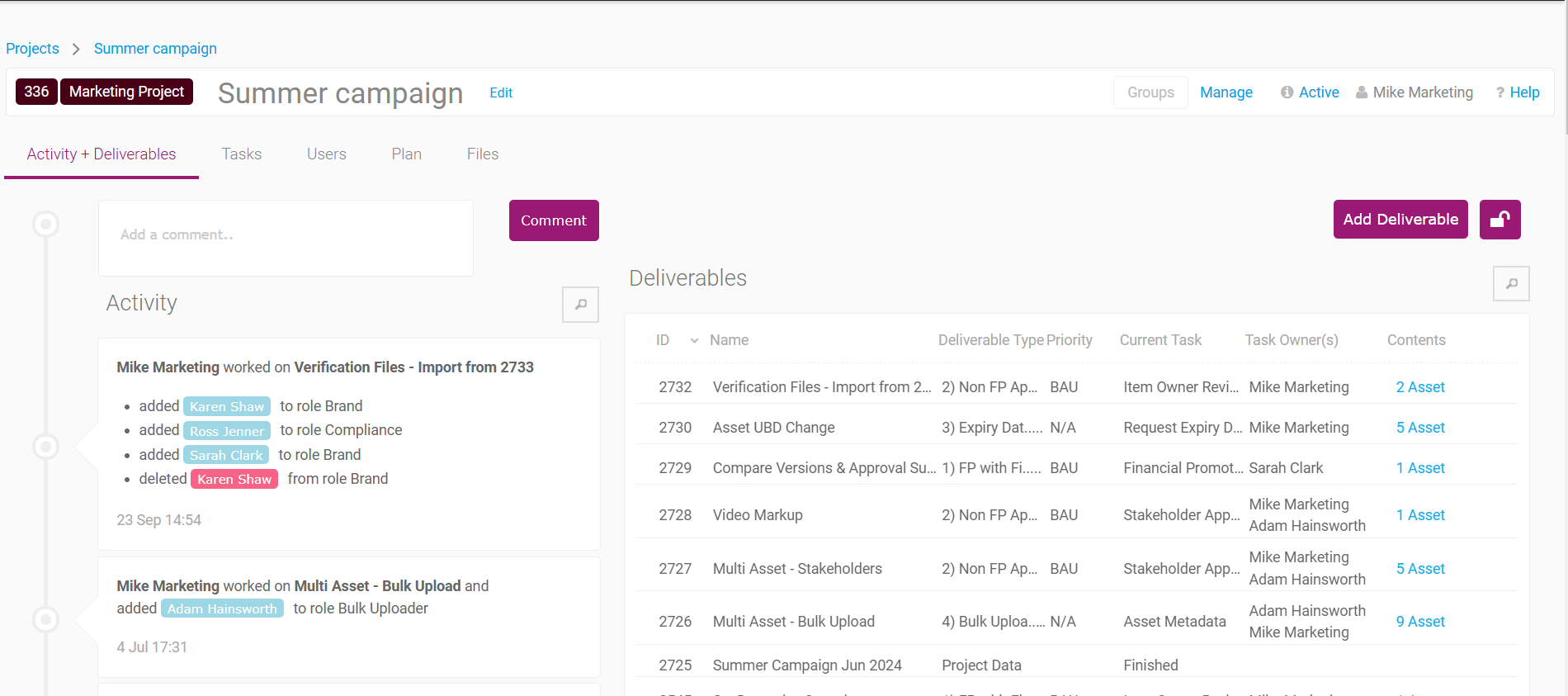

Every action on your financial promotions is captured with bethebrand. From the moment content is created to its final sign-off, you’ll have a complete, detailed audit trail. Senior management and auditors get a transparent view of every version, approval and annotation. This level of control and visibility ensures your compliance process stands up to scrutiny every time.

Track every detail, including version histories, checklists, annotations, briefs, and approvals. Our audit trails provide complete reporting for financial promotions compliance, ensuring every action is documented in an easy to review format for both internal and external reviews.

Compliance mistakes are costly. bethebrand reduces the risk of non-compliance with automated checks, enabling your team to check financial promotions adhere to FCA regulations right from the first review. Whether verifying claims or ensuring adherence to consumer duty, bethebrand gives your team the tools to meet regulatory standards with confidence. Get it right first time, reduce the chance of breaches and speed up approvals.

Automated content reviews highlight any copy against predefined rules before it reaches approval, reducing errors. Plus, consumer duty requirements are built into the approval process to ensure full compliance.

With our platform, users can set automatic review dates based on each promotion’s risk level. High-risk assets get the attention they need, while low-risk materials move through quickly. This means you can focus where it matters most and get compliant materials to market faster.

What is financial promotions compliance software?

Financial promotions compliance software helps regulated firms manage the creation, approval, and distribution of marketing materials in line with FCA rules. It provides clear workflows, audit trails and automated checks to ensure promotions are fair, clear and not misleading.

How does bethebrand help organisations meet consumer duty requirements?

Bethebrand integrates consumer duty requirements directly into the approval process for financial promotions. By automating compliance checks, verifying claims, and ensuring clear, fair, and non-misleading promotions, bethebrand helps your team confidently adhere to FCA regulations and consumer duty standards.

How does bethebrand enable compliance with FCA regulations?

bethebrand automates the entire compliance process by integrating FCA guidelines into your workflows. It ensures that every financial promotion goes through rigorous checks, including automated text reviews, substantiation of claims and full audit trails, to meet regulatory standards.

Can I manage multiple financial promotions at once?

Absolutely. bethebrand allows you to upload, track and approve large volumes of assets in bulk. This is especially valuable for firms managing campaigns across multiple channels or product lines.

What kind of audit trail does bethebrand provide?

bethebrand offers a detailed, permanent audit trail for each financial promotion. This includes version histories, checklists, annotations, approval records and supporting documents, ensuring full transparency for internal reviews and external audits.

How does bethebrand help reduce the risk of non-compliance?

bethebrand automates the review and approval process, reducing the chance of human error. It also includes automated reminders for content reviews, risk-based review frequencies, and breach alerts to ensure your financial promotions remain compliant.

Can I customise workflows to match my company’s compliance processes?

Absolutely. bethebrand offers pre-built templates and the option to create fully customisable approval workflows that can be tailored to meet your organisation’s specific compliance requirements, ensuring consistency and standardisation across all your financial promotions.

If you would like to explore our system further, please:

Join our mailing list for latest bethebrand news:

Thank-you for reaching out to us, you will hear from us soon.

Unfortunately we had an issue signing you up, please contact support directly at support@be-thebrand.com

By clicking “Accept all cookies”, you agree that bethebrand can store cookies on your device and disclose information in accordance with our Cookie Policy.